In turn, Aristeia, which manages $3 billion in investor money, has accused Sina of "failing to hold itself to the standards expected of U.S.-listed public company boards."

Foreign investors seem less than worried about any lack of control or lapses in corporate governance if the market is any indication. Shares in those companies have been on a tear in markets around the world as Chinese consumers reliably use their smartphones to buy electronics, shop for groceries, make investments, play games and look for dates.

With more than 700 million users, China is the world's largest single internet market. Weibo has 313 million monthly average users.

Still, some investors are quietly complaining about corporate governance practices.

Chinese companies that list shares in the United States are not necessarily subject to American rules. Most are incorporated in light regulatory jurisdictions like the Cayman Islands.

As a result, Chinese companies often behave differently. While Sina holds a regular annual meeting, some of its peers do not, a standard for the United States. Baidu, the search engine giant, has not held an annual shareholder meeting since 2008. JD.com, the online retailer, has never held one.

"Investors have been getting a bit fed up with companies like Baidu and JD.com not having general meetings," sa id Jamie Allen, the secretary general of the Asian Corporate Governance Association.

A spokesman for JD.com said: "Investors appreciate our candor both on earnings calls and in engagement throughout the year. This issue has rarely, if ever, been raised to us." Baidu did not respond to requests for comment.

Foreign investors also typically have fewer shareholder protections. To get around Chinese restrictions on outside investments in sensitive industries, many companies use a complicated legal structure, called a variable interest entity, or V.I.E. Under those arrangements, shareholders have rights to the profits of a company, but they do not control key assets — potentially leaving them exposed if the company runs into trouble or the Chinese government declares the structure illegal.

Sina was a key player in the Chinese internet's emergence as a social and economic force. Its Weibo service, once derided by critics as a knockoff of Twitter, has grown in size and functionality to the point where it is now a must-read for many people.

Even after the Chinese government curbed political or controversial discussion on Weibo, it remains a well-read resource. Weibo now has its own stock listing, while Sina owns a 46 percent stake. Sina's other operations include online news and entertainment.

That separate listing helped set off the fight with Aristeia. Sina's shares have risen nearly 75 percent so far this year. But Weibo's performance has been better, with the stock more than doubling. Based on their stock market values, Weibo is now more than twice as valuable as Sina — a gap that Aristeia says points to lackluster management and poor corporate governance.

Sina uses a V.I.E. structure. Only one of the five director seats is available each year. The chairman and chief executive, Charles Chao, has a permanent position; the other members serve four-year terms.

Aristeia is pushing for representation on the board so that directors will consider measures that would result in more money for shareholders. The se include a sale or merger of Sina or Weibo or a buyback of shares by management.

Sina says that any deal proposed by Aristeia would not clear because of China's complicated telecom and media rules. Alibaba, the Chinese e-commerce giant, also owns a stake in Weibo, further complicating its options, Sina said.

"The time, resources and capital invested to pursue a transaction with a high likelihood of failure, rather than accretive and value creating opportunities, is not in the best interests of Sina shareholders," Sina said in a statement.

Some outsiders disagree. "I think Sina has built in Weibo a very valuable asset that is not being reflected in its share price," said Randy Gelber, a managing director at UBS, the Swiss bank.

"It would seem like there should be some common ground from both sides on how to realize that value," he said.

Two proxy advisers — Glass Lewis & Company and International Shareholder Services — have given some weight to Aristeia's arguments. Glass Lewis recommended that Sina expand its board to allow Aristeia's nominees, and I.S.S. recommended that Sina shareholders support one of the two nominees.

"An examination of the arguments reveals compelling reasons for shareholders to seek change at the company," I.S.S. said.

The fight is being watched closely at a time when American activists are bringing their bare-knuckled approach to Asia. Daniel S. Loeb, one of the most vocal activists, scored a victory in a campaign for change at the Japanese conglomerate that owns the 7-Eleven convenience store chain last year. In South Korea, the activist Paul Singer and his hedge fund firm, Elliott Management, picked fights with Samsung Electronics and the Bank of East Asia in Hong Kong.

It is also unfolding as the Chinese government looks to take a more active role in how its corporate giants are managed.

Even if Aristeia emerges victorious, the real test could be whether its candidates will be able to push for change internally.

"The question is whether that board member would be able to do anything other than jump up and down at meetings," said Paul Gillis, a professor at Peking University's Guanghua School of Management.

Continue reading the main storySource: U.S. Investor Tries to Shake Up Sina, a Pillar of China's Internet

Digit NewsDesk news@digit.in

Digit NewsDesk news@digit.in  Tesla's Model X

Tesla's Model X  The mysterious HTC smartphone

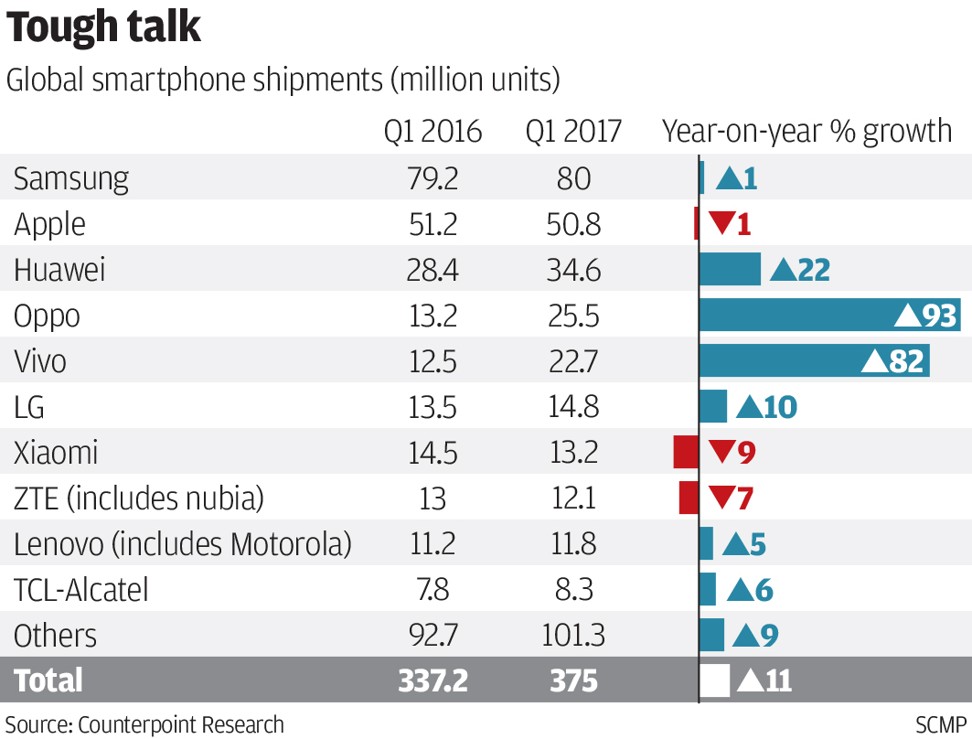

The mysterious HTC smartphone  Vivo and its sibling smartphone brand Oppo, both produced by BBK Electronics, are increasingly branching out abroad as smartphone sales grew at a modest 3 per cent in the second quarter in the world's largest phone market, according to research firm Counterpoint. The two brands are known for their strong offline strategy, where sales is conducted primarily via thousands of retailers, who also manage the relationship with customers and promote the brands to engender loyalty.

Vivo and its sibling smartphone brand Oppo, both produced by BBK Electronics, are increasingly branching out abroad as smartphone sales grew at a modest 3 per cent in the second quarter in the world's largest phone market, according to research firm Counterpoint. The two brands are known for their strong offline strategy, where sales is conducted primarily via thousands of retailers, who also manage the relationship with customers and promote the brands to engender loyalty. Vivo already sells smartphones in Indonesia, Thailand, the Philippines and Vietnam, as well as India, Nepal and Pakistan. The brand is the third-most popular brand in India, with a 13 per cent share of the market.

Vivo already sells smartphones in Indonesia, Thailand, the Philippines and Vietnam, as well as India, Nepal and Pakistan. The brand is the third-most popular brand in India, with a 13 per cent share of the market.

The Porsche phone.

The Porsche phone.