The combined effects of China's economic slowdown, a maturing smartphone industry and market volatility are sending jitters through Asian electronic-parts suppliers, which have relied on Chinese consumer demand and manufacturing muscle to power their growth in recent years.

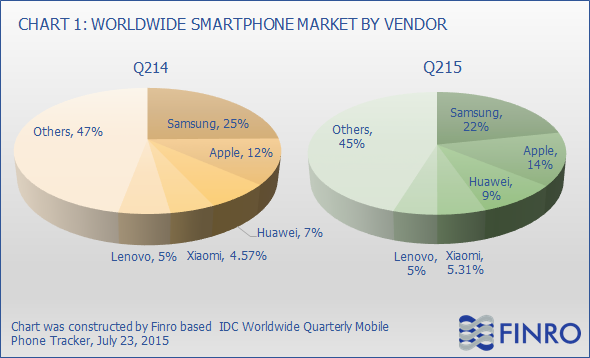

After several years of torrid expansion, smartphone sales are slowing in China as stocks of unsold handsets are mounting in stores and warehouses. World-wide sales of smartphones grew at their slowest rate since 2013, research firm Gartner said this month, with sales in China falling for the first time in the second quarter.

The slowdown in smartphone sales is expected to hit Asian semiconductor giants such as Samsung Electronics Co. SSNHZ 0.00 % and SK Hynix Inc., HXSCF 0.00 % whose memory chips are widely used to store data in the devices. Some Japanese electronics suppliers that operate further up the industry's supply chain—like Fanuc Corp. FANUY -3.17 % , a maker of industrial robots and machine tools used by smartphone makers, and Tokyo Electron Ltd., a provider of chip-making equipment—recently lowered their forecasts for sales and earnings in the fiscal year ending next March.

"I don't think this is a bust, but we're going to have to work through the slowdown," said Amir Anvarzadeh, Japan equity strategist at BGC Partners. "Inventories will have to come down."

The slowdown in smartphone sales in China is also contributing to a decline in the price of liquid-crystal displays, exacerbating the woes of a leading supplier, Sharp Corp. of Japan. The company cited "increased competition in the China market" as a reason for posting an operating loss in its display division in the most recent quarter.

Smartphone sales in China more than doubled from 2012 through 2014, when they accounted for nearly one-third of the global total of 1.27 billion, according to Bernstein Research. But the firm expects sales in China to plateau at about 400 million over the next few years.

Some Chinese handset makers like Lenovo Group Ltd. LNVGY -5.00 % , which have risen in the global smartphone rankings despite only modest sales outside their domestic market, have already reported tepid earnings in the latest quarter. Lenovo Chief Executive Yang Yuanqing said earlier this month the past quarter was possibly the "toughest market environment in recent years."

In the second quarter, Lenovo had more than 12 weeks' worth of smartphone inventories, compared with about four weeks for Apple Inc. AAPL 0.22 % and seven weeks for Samsung, according to Bernstein. Apple Chief Executive Tim Cook assured investors last week that the company's sales in China remain strong.

As Samsung's industry-leading smartphone market share has eroded over the past two years, the company has grown more financially dependent on its semiconductor arm. Chip profits accounted for nearly half of Samsung's operating profit in the second quarter.

Over the past two years, Samsung and SK Hynix, the world's two largest manufacturers of memory chips, have ridden a cyclical upturn in pricing and solid demand for DRAM, or dynamic random-access memory, chips used in products including personal computers and smartphones. Profit margins in this area have risen in a range of 20% to 30%.

Both companies have, in recent months, announced plans to build more chip plants in South Korea to boost their manufacturing capacity. Samsung plans to spend 15.6 trillion won ($13 billion) on a cutting-edge plant to maintain its lead in memory chips, while SK Hynix intends to spend 46 trillion won over 10 years on three new chip plants.

But analysts warn that aggressive investment plans, coupled with the economic downturn in China, could lead to a supply glut in the industry, causing sharper-than-expected chip-price declines. Faced with the new softness in smartphones, the chip industry is getting no help from PCs or tablet computers, whose global sales have already declined. Gartner in July cut its growth forecast for world-wide chip sales this year citing, among other factors, softness in China's smartphone market.

"With an economic downturn, there could be a strong inventory correction for mobile DRAM toward the end of the year," said Lee Seung-woo, an analyst with IBK Securities in Seoul.

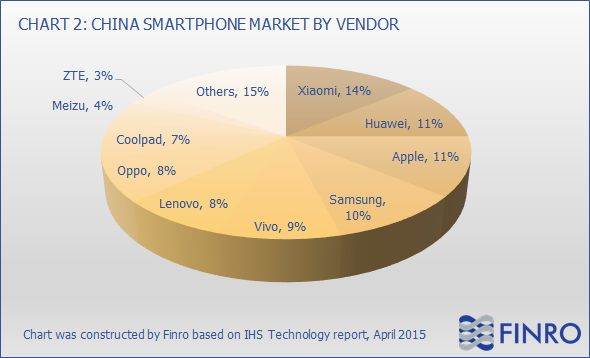

Mr. Lee estimates that SK Hynix sells 40% of its DRAM chips to China. He expects the impact to be less severe on Samsung's chip business as the South Korean company uses a chunk of its memory products for its own smartphones. Still, Samsung has faced significant hurdles in China, with smartphone sales slipping sharply in recent quarters because of stiff competition.

Samsung and SK Hynix don't provide a breakdown of sales by region. Spokesmen for Samsung and SK Hynix declined to comment.

Smartphone parts suppliers could be hurt by unfavorable comparisons with recent quarters, when demand for components and equipment was boosted by strong sales of Apple's iPhone 6 and 6 Plus. Apple designed those phones, introduced last September, with larger screens than previous generations of iPhones, in an effort to satisfy Asian consumers' preferences, and sales in China soared.

Shoji Sato, an analyst at Morgan Stanley MUFG, said the effect of the current slowdown will be uneven for electronics suppliers. Japanese companies such as Murata Manufacturing Co., which makes tiny capacitors for Apple iPhones, and Alps Electric Co., which makes a range of smartphone parts, could benefit from the increasing sophistication of handsets, which requires more expensive components. Some parts providers are also expected to increase sales to other industries, such as automobiles, mitigating weakness in demand from smartphone makers.

"Overall, the component makers' situation is getting tougher than two months ago, but premium suppliers will be OK," Mr. Sato said.

One smartphone parts supplier that continues to ramp up production is Sony Corp. SNE -0.02 % , which makes image sensors for digital cameras, including those in iPhones. The company said in April that during the current fiscal year it will invest ¥210 billion ($1.73 billion) to expand output of image sensors and ¥80 billion to lift production of camera modules.

Despite the slowdown in China, the company says it is struggling to keep up with demand.

"We are carefully monitoring the market because Chinese makers are important in mitigating risk from relying too much" on Apple, a Sony official said. "But the recent Chinese economic conditions have no immediate impact on our business because we are not able to supply enough sensors for customers in China."

Write to Eric Pfanner at eric.pfanner@wsj.com and Min-Jeong Lee at min-jeong.lee@wsj.com

Source: China Slowdown's Next Victim: Asian Parts Suppliers