Over the last couple of years, many new smartphone OEMs have come into our lives, offering high-end devices for low prices. Manufacturers that were completely anonymous before, like Huawei, Xiaomi, OnePlus, and Meizu, became well-known brands and have competed fearlessly with Apple (NASDAQ:AAPL) and Samsung (OTC:SSNLF).

In an article published in November 2014, I described how Xiaomi, one of the rising stars of the Chinese OEMs, is trying to challenge Apple in every segment of the consumer electronics market. One of the main factors in Xiaomi's success is its low operating costs, which allow the company to run successfully with razor-thin margins. This strategy is, of course, not unique to Xiaomi, and most of the other Chinese OEMs are trying to do the same: generate fragile margins from every phone sold that is just enough for a small profit. In large volumes, when the economy grows, this model can work perfectly fine; however, when the global macroeconomic stability is tested, and the growth of the Chinese market slows down, many of the Chinese OEMs may not survive.

Chinese OEMs MarketThe Chinese smartphone OEMs can be split into three tiers:

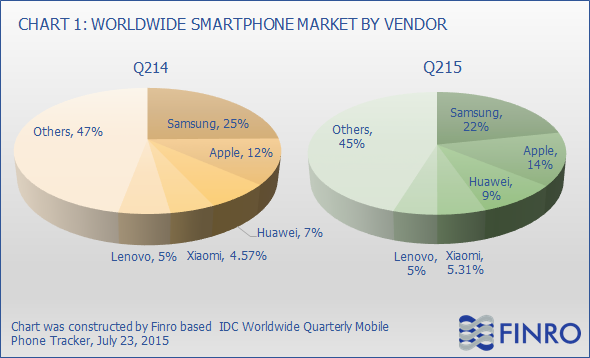

Xiaomi, Huawei, and Lenovo currently account for 20% of the global smartphone market. Assuming that at least 30% of the "others" are Chinese vendors, the Chinese OEMs account for around one-third of the market, which is very close to the combined portion of Apple and Samsung. However, while Apple's and Samsung's combined share constitutes only two vendors that each control a significant market share, the Chinese OEMs' share constitutes dozens of players from the three tiers.

Slowdown in China and Global Smart Phone MarketsThe slowdown in China lowers the demand and, consequently, the volume of shipment in the local Chinese market. If the global unrest continues, the consumers outside of China will re-think about upgrading their current devices. In a recent report, Gartner presented a first-time decline in smart phone sales in China, assessing the drop at 4% per year. Gartner explains that decline: "China has reached saturation - its phone market is essentially driven by replacement, with fewer first-time buyers. Beyond the lower-end phone segment, the appeal of premium smart phones will be key for vendors to attract upgrades and to maintain or grow their market share in China." As the Chinese smart phone market has ended its massive growth and reached a plateau, OEMs of premium devices, such as Apple, Samsung, and the Chinese tier 1 players, will compete for the crown.

In the long run, the total smart phone market is poised to slower growth as stated by IDC, in its recent Q215 smart phone report. The firm forecasts that the YoY growth in total smart phone shipments is going to decline, from 10.5% in 2015 to 5.1% in 2019, which is a sharp drop from the 27% in 2015. The share of the Chinese market also drops from 32% in 2015 to 23% in 2019, which reflects the decrease in demand by Chinese consumers for new smartphones as also described by Gartner.

These changes in the Chinese smartphone market and globally will have significant implications on all the players in the market.

Impact on Chinese OEMsAs described in the reports above by IDC and Gartner, demand for new smartphones in China reached a plateau and was expected to decline over time. As most consumers already own their first phone, it now becomes a game of upgrading and refreshing current devices. In this battle, premium vendors can attract customers by new, high-end, most advanced phones while low-end vendors can offer attractive prices. The Chinese tier 1 players could also attract more customers to their premium devices.

The problems start at tier 2 and tier 3 players. Tier 3 vendors are all small and unknown, mainly selling their products to the local market in China. As the demand for new smartphones is about to decline over the next five years, they are the first ones to experience real damage. If the current decline in China continues, most of these vendors will not be able to stand behind their low-cost model and will have to either merge or close down. As many of the tier 3 providers use white-label designs with tiny adjustments, it is unlikely that they will merge together or be acquired by a tier 1/2 vendor that has its own branded low-end devices. Most tier 3 vendors are likely to disappear in the long run, leaving only a few to offer low-end and extremely low-cost phones.

Tier 2 vendors are a different thing, as these vendors are rising stars in the global smartphone market and are making their first steps in the big league. It is very likely that these vendors will experience difficulties in the short-term but will be able to stabilize in the long run. As these vendors are in the middle of massive investments to go global, they are significantly hurt by the current slowdown and the Chinese smartphone market trend.

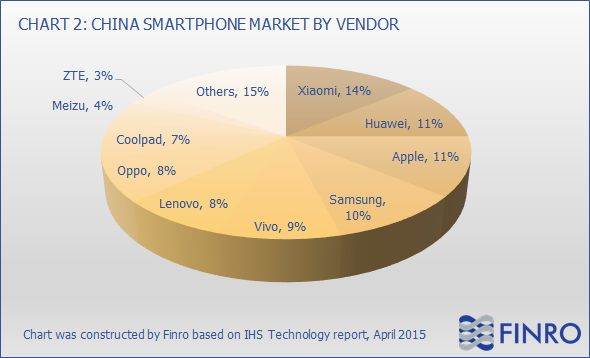

Impact on Apple and SamsungAs shown in chart 2 below, there are only two main foreign players in China's smartphone market: Apple and Samsung. Other leading brands, like Sony (NYSE:SNE), Nokia (NYSE:NOK), Nexus by Google (NASDAQ:GOOG) (NASDAQ:GOOGL), etc, have a really small market share, if any at all.

Apple and Samsung are the big winners of the smartphone market saturation and the current slowdown in China. These two rivals cannot compete with the prices that tier 3 players offer in the Chinese market (even Samsung low-end devices are not comparable in price). Their strengths emanate from high-end premium offering and a strong international brand. They can use this to their advantage over the tier 1 companies when the smartphone market shifts to revolve around features and technology instead of price, using leading-edge innovative technology to capture a larger share of the market.

As mentioned above, in the short term, the tier 3 players will be impacted by the current slowdown in the Chinese economy, and most of the vendors will probably disappear. Even though Apple and Samsung do not compete with these OEMs directly, they pressure the market down in terms of price and phone quality. Once most of these players are out of the market, coupled with the market saturation and decreased sales of new smartphones, the game will shift into Apple and Samsung's playground of innovation and quality.

As most of the leading Chinese vendors have reached their maximum available share in the Chinese market, they are looking to expand globally. Meizu, OnePlus, ZTE, Huawei, Lenovo, and Xiaomi are all working to strengthen their global presence, and each has a different issue to cope with. OEMs that will not be able to expand globally fast enough and survive the current macroeconomic situation in China will disappear and leave more room for Apple and Samsung to take over.

ConclusionThe worldwide smartphone market is experiencing a decline in growth mainly due to a saturation status in the Chinese market. Forecasts estimate that the worldwide smartphone sales will grow slower than they used to, and sales in the Chinese smartphone market are expected to decline over the years. These changes in the smartphone market, together with the current economic slowdown in China, will impact most of the Chinese OEMs. While some of these OEMs will not survive the short-term difficulties, and some may struggle to expand globally - Apple and Samsung are not exposed to these risks. As most of the Chinese first-time phone buyers already purchased smartphones, the Chinese market shifts to a game of features and technology to attract consumers to upgrade their devices. When moving to compete over features and technology innovation, Apple and Samsung have a distinct advantage on most of the Chinese OEMs. This, in my eyes, makes Apple and Samsung very compelling investments for t he long term.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I am/we are long AAPL. (More...)I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information provided in this article is for informational purposes only and should not be regarded as investment advice or a recommendation regarding any particular security or course of action. This information is the writer's opinion about the companies mentioned in the article. Investors should conduct their due diligence and consult with a registered financial adviser before making any investment decision. Lior Ronen and Finro are not registered financial advisers and shall not have any liability for any damages of any kind whatsoever relating to this material. By accepting this material, you acknowledge, understand and accept the foregoing.

Source: Apple And Samsung To Benefit From The Changes In The Chinese Smartphone Market

No comments:

Post a Comment