Introduction

Competition in the global smartphone market, especially for emerging markets, has intensified in the last five years. As new technological innovations for smartphones plateaued, key smartphone vendors, Samsung (OTC:SSNLF) and Apple (NASDAQ:AAPL), failed to create enough value proposition for current users to upgrade to new versions.

This lag in innovation allowed new and cheap smartphone vendors to catch up to Samsung's and Apple's products.

Because of being low-priced competitors with great technologies, new players such as Huawei and Xiaomi (Private:XI) have managed to gain substantial global market share at the risk of Samsung and Apple. If this trend is allowed to continue, Samsung and Apple could see their market shares plummet as consumers move to cheaper but advanced competitors.

But we believe Apple's recent announcement of the low-priced iPhone SE will help the company mitigate its market share deterioration by tapping into new markets as it expands its total addressable market ("TAM") and brings more people to its ecosystem.

The Huawei and Xiaomi effect - Apple's portion of global shipment volume declined between Q4 2012 and Q4 2014

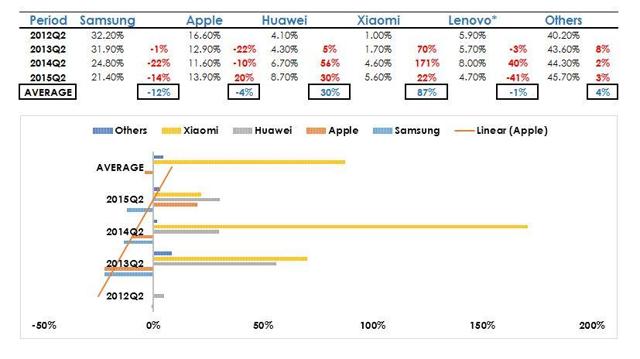

Apple has been losing global market share because of low-priced competitors such as Xiaomi and Huawei. In the last three years, companies like Samsung, Apple and Lenovo (OTCPK:LNVGY) have seen their worldwide vendor market share decline by an average of 12%, 4% and 1%, respectively.

(Source: Authors financial analysis with data taken from the International Data Corporation) Click to enlargeOn the other hand, average market share growth rate for Huawei and Xiaomi between Q2 2012 and Q2 2015 is 30% and 87%, respectively.

Click to enlargeOn the other hand, average market share growth rate for Huawei and Xiaomi between Q2 2012 and Q2 2015 is 30% and 87%, respectively.

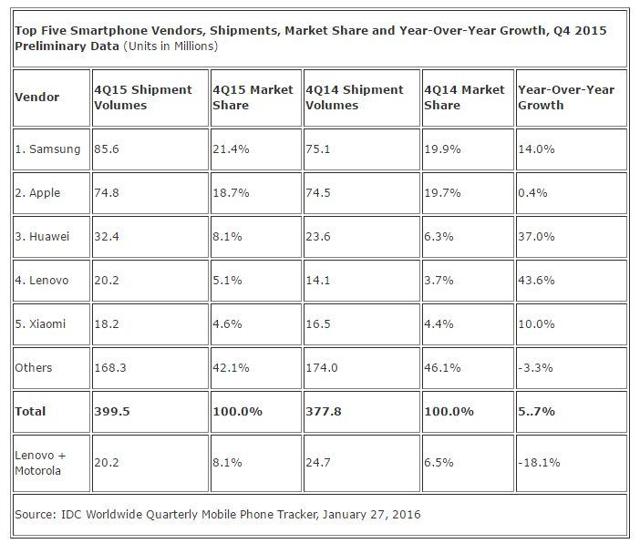

This decline in the global smartphone market is a threat to Apple's long-term growth. Q4 is usually Apple's best quarter, but its portion of global smartphone shipment volume fell from 19.7% in Q4 2014 to 18.7% in Q4 2015 as shown below:

(Source: IDC Research Inc. - Q/Q Global Smartphone Market Shares) Click to enlarge

Click to enlarge

In the same time period, some of Apple's competitors such as Samsung, Huawei, Lenovo and Xiaomi saw their portion of global units shipped increase.

Samsung and Apple losing market share: Huawei and Xiaomi gaining it

The Huawei and Xiaomi threat is real and imminent. Samsung, Apple and Lenovo are losing popularity to new, cheap and advanced players.

But one would wonder why should Apple investors care about low-cost smartphone competitors such as Huawei and Xiaomi since Apple's products are premium and not discount products?

Apple and its investors should care because of several reasons.

First, this is important for Apple because it cannot repeat the Samsung mistake of underestimating Huawei and Xiaomi in a market that accounts for ~24% of AAPL's total sales. By Q2 2012, Samsung was capturing ~32% of total global smartphone market share. Samsung tried to compete against Apple and neglected the small players. This mistake has cost Samsung more than 10% in market share in less than three years.

In Q1 2016, Greater China accounted for ~24% of Apple's total sales. Because of how important China is to Apple's projected future growth, the company needs to pay attention to Huawei and Xiaomi because they threaten its estimated growth prospects in the mainland. For instance, Xiaomi's hardware has created a lot of attention. The Mini Note was in such high demand that it sold out in under three minutes and that is after Xiaomi's VP revealed that the sale received over 220 million reservations. Xiaomi's phones offer the best features of a smartphone at half the price. Xiaomi is planning to grow by targeting iPhone users with rumors of a trade-in program for the iPhone 5s and iPhone 6 for Xiaomi's Mini Note and Mini Note Pro. Besides, Xiaomi is not an ordinary start-up. Three of top nine positions in Xiaomi are occupied by former Google (NASDAQ:GOOG) (NASDAQ:GOOGL) employees. It was the third largest seller of smartphones in the world by mid-2015 and it overtook Samsung and Apple t o become the largest smartphone seller in Asia.

Second, moving forward, Apple cannot continue growing at historical levels by hiking prices y/y because smartphone innovations have plateaued.

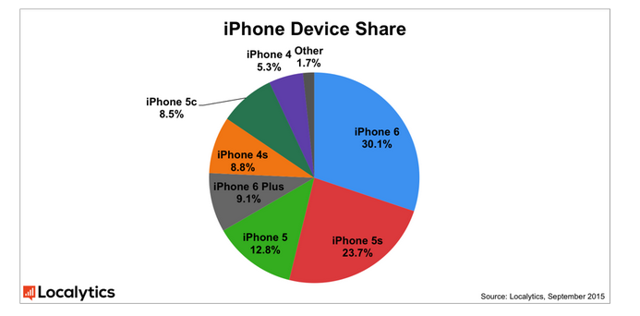

But the total number of consumers upgrading is growing smaller. For instance, there are, respectively, 12.8% and 23.7% of Apple customers still using the iPhone 5 and the iPhone 5s models.

(Source: Localytics) Click to enlarge

Click to enlarge

This decline in new iPhone adoption is likely because people do not see the reason to upgrade their phones. There is no real innovation to justify higher prices for newer models. This has made startups like Huawei and Xiaomi, with cheaper smartphones but as technologically advanced as Apple and Samsung, very common.

iPhone SE: Opportunity to expand TAM and grow ecosystem in emerging markets

The growing popularity of competitors such as Huawei and Xiaomi in Greater China, the lack of new innovations on smartphones and the declining adoption rate for new iPhones threaten Apple's long-term growth rate.

This is why we believe that Apple's announcement of the low-priced, 4-inch iPhone SE is a step ahead in the right direction.

The iPhone SE price tag allows Apple to expand its total addressable market ("TAM") in emerging markets without diluting its brand image. The starting price for an iPhone SE is $399. This price tag is still expensive in emerging markets, but it also broadens the number of people who want to own an iPhone but cannot afford the current prices.

We believe that this opens up new markets for Apple and has the ability to expand its TAM because of Xiaomi. Xiaomi is often referred to as the "Chinese Apple" because its products all look like Apple products.

Xiaomi Mi4 on the left and the iPhone 5s on the right.

(Source: The Verge) Click to enlarge

Click to enlarge

Xiaomi's Mi Router Mini closely resembles Apple's Magic Trackpad.

(Source: Cult of Android) Click to enlarge

Click to enlarge

Xiaomi's CEO Lei Jun has also borrowed the iconic "one more thing" slide from the late Steve Jobs.

(Source: Cult of Android) Click to enlarge

Click to enlarge

One of the major differences between Xiaomi and Apple is that XI sells iPhone-like gear for a third of AAPL's products. But Xiaomi's phones are as technologically advanced as any smartphone in existence. It manages to provide cheap smartphones because they price just above cost.

This implies that the market for Apple's products is there, but most people cannot afford the prices. Therefore, although the $399 for the iPhone SE is still relatively high, it is below Xiaomi's Mi5 prices, giving Apple a competitive edge with price-sensitive consumers who would prefer the original iPhone rather than the copycat.

This is why we believe that the iPhone SE has potential to aid Apple in expanding its ecosystem in emerging markets like China.

Conclusion

But Apple's low-pricing might have some problems moving forward. First, we expect Apple to experience deteriorating margins moving forward because the price reduction shifts its net income dependency from higher mark-up prices to turnover. But since this is a new initiative, it is possible that the turnover from the low iPhone SE prices might not be enough to compete for Apple's lower prices. Secondly, Apple still lags behind in its effort to penetrate and effectively compete in the low-cost market with the likes of Xiaomi and Huawei on phone size. The iPhone SE might set a foundation for AAPL to appeal to the low-cost market, but it will still lose market share from people who prefer a bigger but cheaper phone.

Nonetheless, we believe that the new opportunities that the iPhone SE low-pricing will bring to Apple in Q2 2016 and beyond will outweigh the aforementioned disadvantages. This is because a low price point has the potential to tap into new markets in Apple's strong markets such as America, Europe and China. Furthermore, even if we see lackluster sales growth in iPhones, if Apple manages to expand its ecosystem with the low price, it will be able to sell more of its products to newcomers. Consequently, the iPhone SE has the potential to help Apple grow its global market share as it expands its TAM.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Apple: The Value Of The iPhone SE In A Challenging Smartphone Space

No comments:

Post a Comment