Paying for food with a messaging app. Photo credit: McDonalds.

"We need banking but we don't need banks anymore," said Bill Gates two decades ago, predicting the explosion in startups creating web and app-based financial services that we're seeing right now. With nearly US$11 billion last year invested into so-called fintech startups across Asia, the sector is rivaling online shopping and ride-hailing among the hottest tech arenas.

As this seismic shift takes place, nowhere is it more visible than in China.

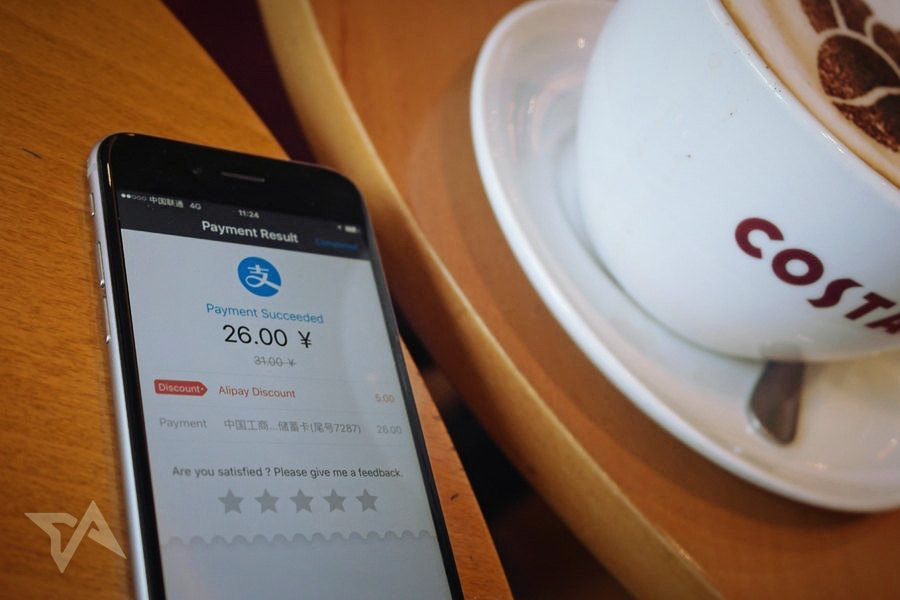

At a Starbucks in Shanghai, a punter pays for coffee with a messaging app, waving their phone in front of a barcode scanner. At the sushi joint next door, a customer settles the bill with a mobile wallet app; after lunch, she pays an electricity bill with the same app, and then moves some of her salary into a high interest personal fund. No notes are counted out, no coins bounce and clatter into cash registers, no-one queues at the bank.

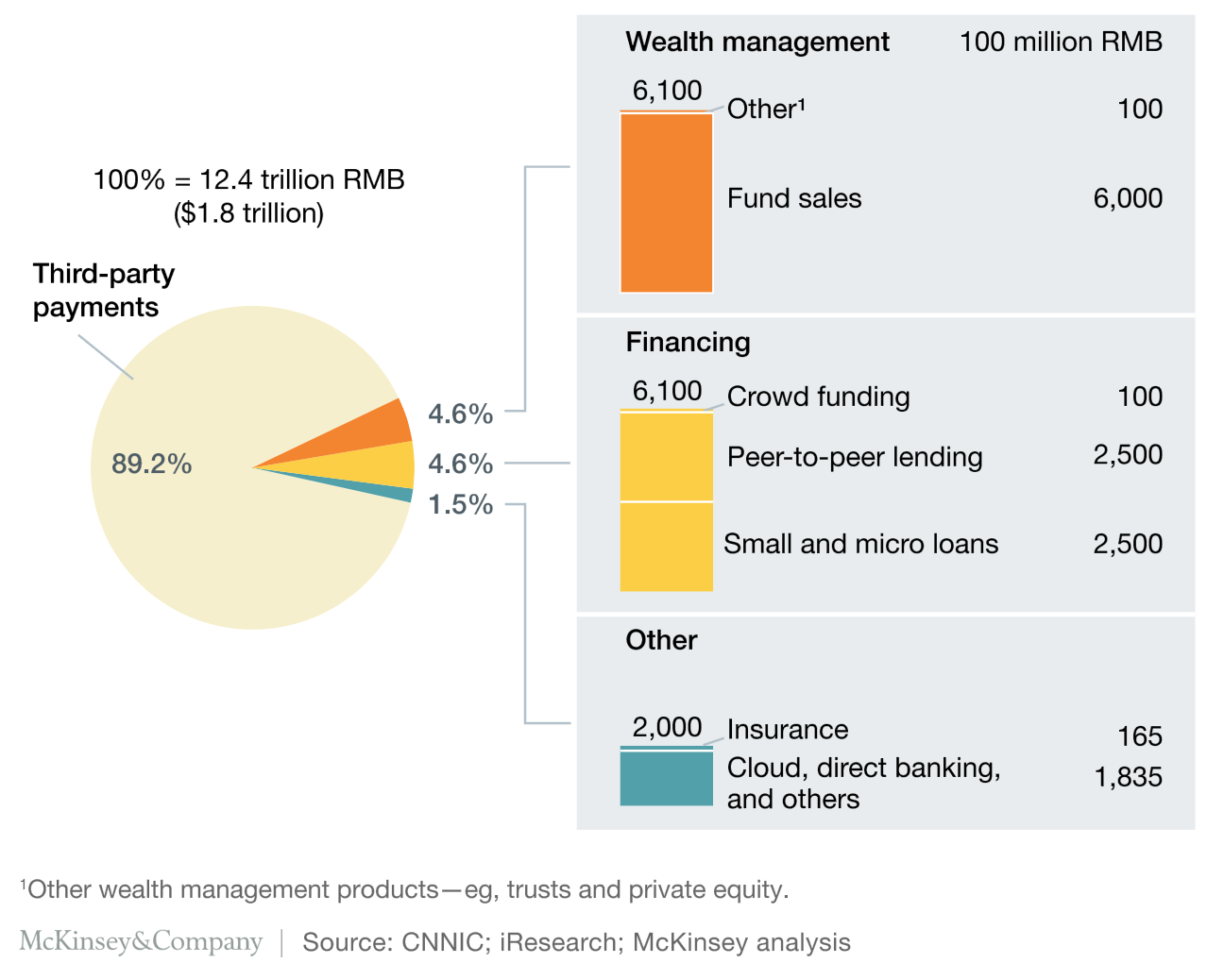

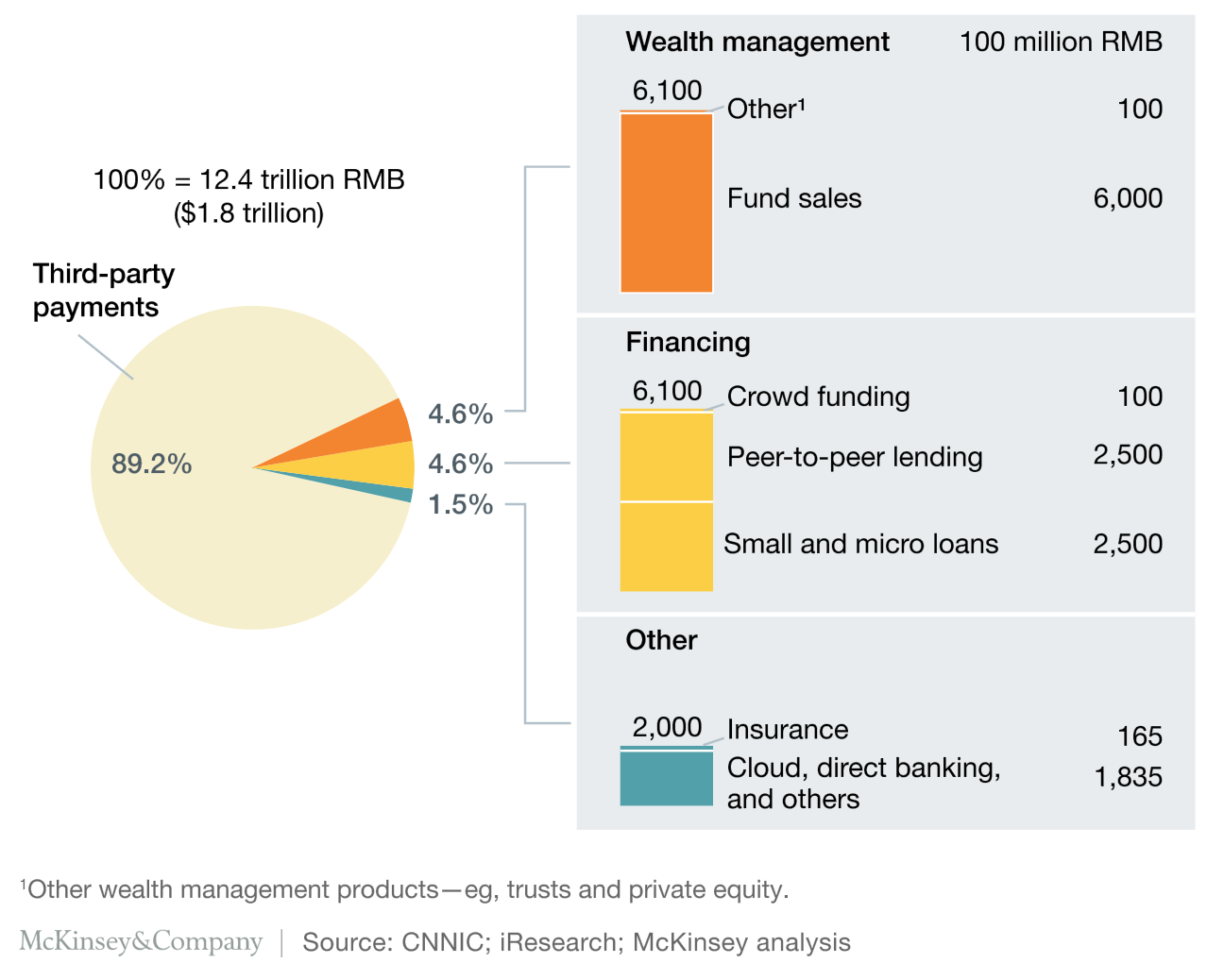

"The country leads the world when it comes to total users and market size," observed a McKinsey report last year about China's fintech boom, with people entrusting US$1.8 trillion in 2015 to online finance services of all shapes and sizes.

Data is for end of 2015.

China's overall fintech market is now worth up to US$2.2 trillion.

By looking at China's main fintech sectors, we can sketch a picture of how this will shape up around the rest of the world.

Scan me: the surge in mobile payments

China's shoppers pay with their phones more so than people in any other country – a record 195 million did so for in-store and online payments in 2016, rising to an anticipated 332 million in 2020, says Emarketer. Leading the way are WeChat, the turbocharged messaging app from Tencent, and Alipay, the wallet app run by Jack Ma's Ant Financial.

Apple, Huawei, Samsung, and Xiaomi have their own wallet apps, but they have few functions in comparison to WeChat and Alipay. They're all fighting over US$1.8 trillion in mobile payments, collectively accounting for 89.2 percent of the transactions in China's fintech space, according to McKinsey.

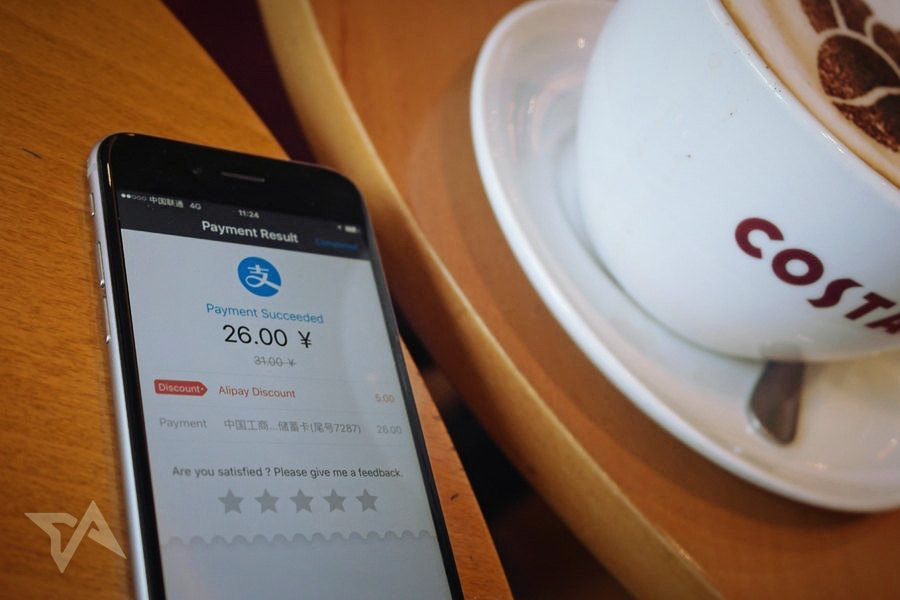

Alipay app shown after being used to pay for coffee.

In China, mobile payments have proved to be a gateway drug for more hardcore fintech services, showing that getting people into wallet apps and giving them a real-world and convenient use case is the first and highest barrier.

WeChat and Alipay have exploited this best, using the muscle of their tech titan parents – Tencent and Alibaba – to build an array of financial services into their apps, which are used daily by hundreds of millions of people.

Alipay, being dedicated to payments, whips WeChat on sheer numbers. Indeed, Alipay is so huge that it makes Visa look like a laggard. Alipay recently hit a record one billion transactions in a single day, with a peak of 120,000 transactions per second – well above Visa's capacity of 24,000.

See: Here's how hot fintech got in Asia in 2016

Lend me a few bucks: the rise of peer-to-peer loans

The rise of WeChat and Alipay points to an irony of the supposedly disruptive fintech sector in China – it's largely dominated across the whole spectrum by multi-billion-dollar giants. Startups compete and endeavor to pick up the scraps, but to win they need a nuclear arsenal of funding or corporate backup.

Plus, China's traditional financial institutions have been quick to adapt – and to disprove Bill Gates' dictum that they're dinosaurs.

Hey, we're huge and you can trust us!

The leader in China's fast-growing online loans business is a spin-off from US$96 billion Ping An Insurance, which quickly set up three subsidiaries to explode into the fintech arena. Thanks to those quick moves, the massive firm now runs Lufax, China's biggest peer-to-peer lending platform. It's basically an Uber for loans, connecting people seeking a return on their savings with cash-strapped people in need of loans.

Valued at US$18.5 billion, Lufax is reportedly plotting an IPO to raise about US$5 billion.

But there's a Wild West side to it all.

Last year's US$7.6 billion Ponzi scheme scandal, affecting 900,000 people, in which the bosses of one peer-to-peer loans startup ran off with everyone's savings, initially seemed like a deadly blow to the burgeoning online lending industry. But it ultimately played into the hands of Lufax and the other tech giants moving into fintech, allowing them to say, hey, we're huge and you can trust us.

Shortly after the controversy, loans startup Dianrong, valued at around a billion bucks ahead of a possible IPO this year, resorted to billboards saying, "Honestly, we won't run away!"

The country had 1,778 "problematic" online lenders last year, stated the China Banking Regulatory Commission, so the peer-to-peer lending segment has not yet killed off all its bad actors.

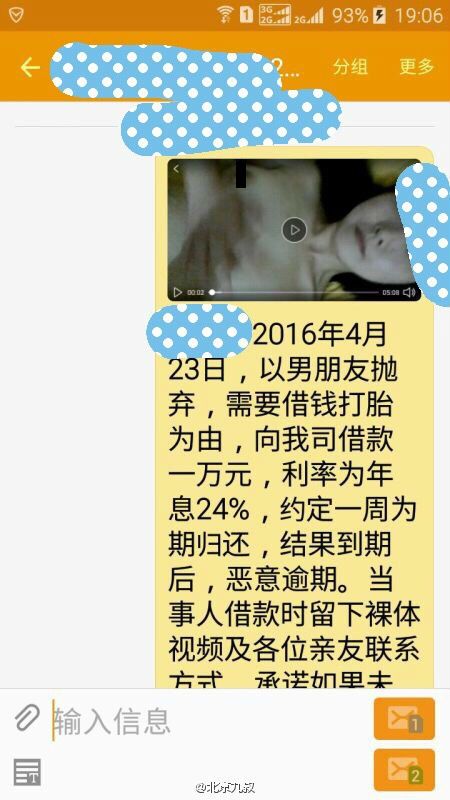

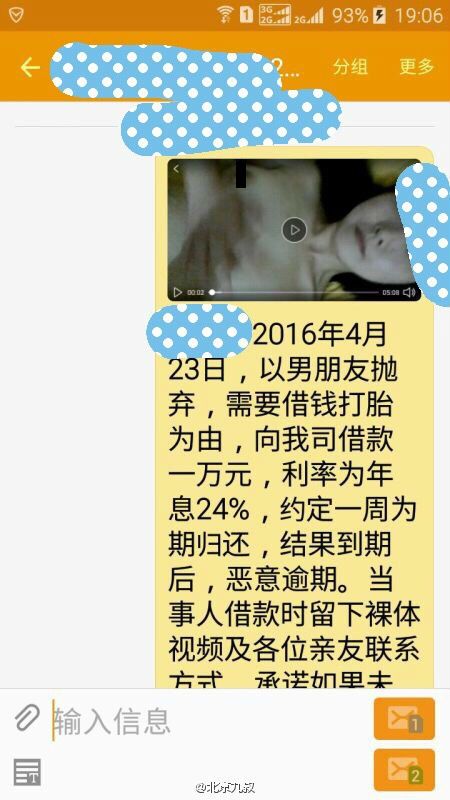

And there's a seedy side as well. Some online loan sharks have forced college students to hand over naked selfies as collateral. Failure to pay back the loan will result in the nude photos being posted online or mailed to the students' parents.

A female college student sends a nude video clip of herself to an online loan shark as she agrees to the terms of the loan for RMB 10,000, approximately US$1,450. Image credit: Weibo, via Quartz.

But Dianrong, Lufax, New York-listed Yirendai, et al, have emerged largely unscathed – and their continuing growth shows that China's online loans space is still a hot sector. It's evolving, too, as authorities sketch out regulations.

Soul Htite, co-founder of Lending Club, the world's largest fintech startup in its niche, is also the creator of Dianrong. Rather than negating the need for banks, he's tapping two Chinese commercial banks to serve as the startup's custodians in a bid to boost credibility with consumers and avoid a repeat of the 2016 Ponzi fiasco.

Elsewhere in the new cash lending business, Chinese startups have been experimenting with online shopping via payments in installments. Two sites in this vein – Qudian and Fenqile – have collectively raised over US$1.2 billion to pursue this. As is always the case in China's tech landscape, there's the risk of being trodden on by a giant – which happened to these startups when Alibaba arch-rival JD rolled out its own installment payments option.

Check me out: fixing the credit history conundrum

A big cloud hangs over this glittering new boomtown – how to assess risk when China barely even has a credit rating system.

For a number of China's fintech startups, social media is the answer.

Loan applicants submit their main social media accounts, which the companies feed into their data-chomping machines in search of reckless behavior or credit card junkies. Some go further, monitoring the applicant's keystrokes on their phone as they fill in the form, casting an eagle AI eye on speedy copy-pasters or people who go straight for the largest loan amount.

With over half a billion netizens and smartphone owners, much of the fintech action in China is on mobile. Photo credit: Jens Schott Knudsen.

Such social media spying is now being adopted by loans startups in India and across Southeast Asia.

Alipay is so huge that it makes Visa look like a laggard.

Alibaba's Sesame Credit, accessible within its Alipay app, does things its own way. It taps into Alibaba's own ecommerce empire to get a picture of safe or risky lenders. By looking at someone's shopping history within its own Taobao and Tmall stores, Jack Ma's firm is creating a credit rating system that forms the bedrock of its other financial products.

This kind of unconventional approach is spreading to business loans too. Dianrong recently started advancing cash to small business owners looking to grow their ventures, poking into the store's books via its digital cash register. It can collect cash digitally via the registers too.

See: New $1.5b fund fuels fintech boom

You can bank on me: the personal finance boom

In China, banks are not being made extinct – they're turning into online banks. Both the tech giants and the banks themselves are doing this, sometimes in tandem.

Baidu, China's top search engine, recently set up shop in partnership with CITIC Bank, a partnership that covers co-branded credit cards as well as online financial offerings.

China's two most valuable tech companies are instead going the online-only route. Alibaba opened MyBank mid-2015 ready to hand out loans up to US$800,000 – as well as the kind of smaller loans that banks normally wouldn't bother with. MyBank complements a number of other services from Ant Financial, Jack Ma's Alipay-oriented spin-off, aimed at China's savers, such as Yu'ebao, a personal fund that promises higher returns than the banks.

Alibaba co-founder Jack Ma is China's second richest individual – and its wealthiest tech boss. Photo modified by Tech in Asia; original photo credit: UN Climate Change.

Tencent got there first, opening China's first major online bank at the start of 2015. Thanks to its social media clout, WeBank is easily accessible to the 846 million active users of WeChat, plus the 877 million on QQ. Not to be outdone by arch-rival Alibaba, Tencent has a personal wealth fund too, Licaitong, that's baked into WeChat.

China is encouraging these new institutions as part of a broader shake-up of the private banking system. "The government won't leave you in the cold. A warm spring will be created for the new private banks," said Premier Li Keqiang in attendance at WeBank's launch.

Watch over me: on-demand online insurance

Online insurance is the smallest slice of China's fintech pie, but it's still a tasty morsel.

It should be no surprise by now that heavyweights have this sector locked down too. Indeed, three of China's very biggest names – Alibaba, Tencent, and Ping An Insurance – came together in 2013 to set up an online-only insurer called ZhongAn.

"The year 2013 is widely regarded as Year One of China's Internet finance era, with a bunch of blockbuster activities such as the launch of Yu'ebao and WeChat payment," notes the McKinsey report.

It's grown massively in that time, with the US$2.2 trillion industry being marked by innovation – five of the top 10 trailblazers on a KPMG list are Chinese – as well as its pervasiveness in everyday life in the country.

Whatever comes next in fintech in China – blockchain technology? More AI and automation? – the rest of the world will be watching attentively and taking notes.

Converted from Chinese yuan. Rate: US$1 = RMB 6.84.

Source:

China's fintech industry shows where the rest of the world is heading

Oppo, Vivo lead in China; Xiaomi slips because of lack of innovation

Oppo, Vivo lead in China; Xiaomi slips because of lack of innovation

CHINA

CHINA HONG KONG

HONG KONG INDIA

INDIA INDONESIA

INDONESIA JAPAN

JAPAN MALAYSIA

MALAYSIA PHILIPPINES

PHILIPPINES SINGAPORE

SINGAPORE TAIWAN

TAIWAN THAILAND

THAILAND VIETNAM

VIETNAM