It's perhaps the most unscientific way of determining a shift in phone fortunes. But after over a decade of hearing this happen, I believe I've found the first sign of coming mobile dominance (or decline): the ringtones you hear on public transport, the first class compartments of Mumbai locals, for instance. Long before data confirmed the ebb in its fortunes, Micromax's distinct sitar soaked caller tune was ceding ground to the ebullient chiming of a tune Xiaomi simply calls Mi. Just as Nokia's ringtone gave way to Samsung over half a decade ago, and Samsung shifted to accommodate Micromax over the last couple of years.

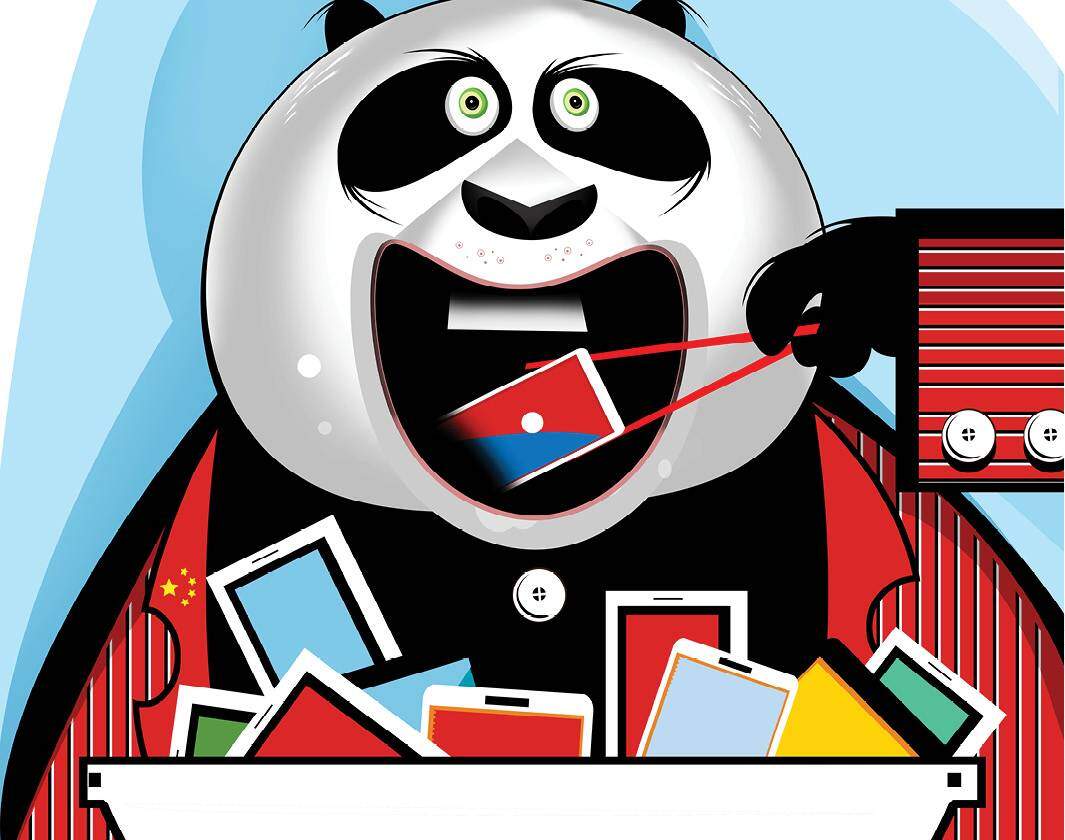

It's perhaps the most unscientific way of determining a shift in phone fortunes. But after over a decade of hearing this happen, I believe I've found the first sign of coming mobile dominance (or decline): the ringtones you hear on public transport, the first class compartments of Mumbai locals, for instance. Long before data confirmed the ebb in its fortunes, Micromax's distinct sitar soaked caller tune was ceding ground to the ebullient chiming of a tune Xiaomi simply calls Mi. Just as Nokia's ringtone gave way to Samsung over half a decade ago, and Samsung shifted to accommodate Micromax over the last couple of years.It's no secret that Chinese smartphone handset makers, as a collective grouping, have a domin ant share of the Indian market — the Korean Samsung still maintains its lead. According to an IDC report, the Chinese vendors have grown by a staggering 142.6% which translates into a 51.4% share of smartphone shipments in India. The share of homegrown vendors has fallen to 13.5% in the first quarter of 2017 from 40.5% in Q1 2016. News reports quoting CyberMedia Research believe the dominance could extend in the quarter through June

It seems like only yesterday that Micromax topped the leaderboard after years of snapping at the heels of Samsung — it was actually in 2014-2015 — before settling down as a strong No 2. Intex frequently made it to the Top 5. So, what happened?

After making history, the Indian brands didn't learn from it

The decline brings with it a heady whiff of déjà vu. Indian smartphone makers fell to ruses from the same playbook they'd used to dislodge the likes of BlackBerry and Nokia; brands that were big, complacent and unable to see the future or react in time. In Nokia's case it was dual-SIM phones. With BlackBerry, it was smartphones. With the Indian players, it was their relatively sluggish adoption of 4G. An industry insider who wishes to remain anonymous says, "The single biggest shift last year was Reliance Jio. The market moved faster than anticipated. Some players read the market wrong and their folio was overwhelmingly skewed towards 3G." As a result, Indian brands went quiet, realising it was pointless spending to promote a feature set that was lacking. A void that the Chinese manufacturers were only too happy to fill.

Indian phone makers exhibited 'unenlightened selfie interest': ignoring the sheer power that staking a claim to the 'selfie', conferred on a brand. India currently leads the world in selfie-related deaths, if some media reports are to be believed. Even disregarding that dire statistic, the rise of Instagram, Snapchat and burgeoning popularity of apps like musical.ly, shows a heavy skew towards the use of front-facing cameras. It was ripe for the taking, but the people doing the taking were the Chinese brands. As Gionee, Vivo and Oppo (the last two are owned by the same firm, BBK, which also counts OnePlus as a wholly owned subsidiary) squabbled for the mantle of selfie expert, the Indian brands were entirely out of the frame.

The Indian brands were out of touch with how much the customer was willing to pay

These brands began as traders and price warriors. And while that mindset helped them get this far, it's been hobbling their growth ever since, believe the experts. Their initial offer was often a spec sheet similar to a leading brand but priced below the `10,000 mark. What the Chinese brands did was explode the `10,000 plus market, allowing them the leeway to go in for a more premium feature set. As marketing consultant Jagdeep Kapoor of Samsika puts it, "The Indian players should have made their brand count instead of making it discount! The Chinese moved up the ladder from product to brand as the Indians moved down from brand to commodity. They didn't realise the smartphone is something consumers don't just use, but show off."

They lost track of who and what consumers found cool

Over the last few years, the Chinese smartphone makers have commandeered every Indian celebrity that matters. Deepika Padukone is endorsing Oppo, Ranveer Singh is peddling Vivo, Alia Bhatt and Virat Kohli are mouthpieces for Gionee and even the Big B has been harnessed to flog OnePlus.

But perhaps the biggest coup was by Vivo, joined at the hip to India's most viewed sporting league. Says Vivek Zhang, CMO, Vivo, "Our association with IPL starting 2016 proved to be a major milestone." Encouraged, Vivo has tied up with the Pro Kabbadi league for five years. Says Zhang, "Going forward, we are focusing significantly on our strategic associations across genres to reach our customer base."

Cont rast that to Micromax which, pursuing global ambitions, went in for Hugh Jackman, a star that the hinterlands didn't recognise or care much about. And then last year, it did an ad in English with a starcast whiter than a Ku Klux Klan rally. And yet another with a 'desier than thou' vibe starring comedian Kapil Sharma ranting against English. It left consumers confused about who or what the brand really stood for. Intex relied on the dubious star appeal of Farhan Akhtar and bet big on the Gujarat Lions who finished second last in the IPL. Celebrities of course can't rescue a brand, but if the communication strategy involves a billboard and TV blitzkrieg, it helps having the most popular faces on your side.

The desi brands squandered their opportunity to lead

All the experts conclude Indian brands could have used the time they'd pulled ahead a lot better. Says Nilesh Gupta, managing partner, Vijay Sales, a Mumbai-based durables retail chain, "Had they setup R&a mp;D and manufacturing, the game would have been different. If your source starts to sell directly, they will outsmart you." Xiaomi succeeded, relying on an online first model and extraordinary levels of brand loyalty — fans promoting phones and other products to friends, colleagues and fellow netizens, according to Manu Jain, MD for Xiaomi India. If Indian brands were thinking on these lines, there's precious little to show for it.

Next is What?

The old Samsung tagline is probably giving CMOs at the desi phone brands sleepless nights. As the industry insider puts it, "A good analogy is a lion charging a herd of buffalos. Your strategy individually is to be only faster than the slowest buffalo. For each player, there are other more vulnerable brands you can steal share from." He recommends not taking the Chinese head on but finding a space or a price range where a brand can be a Top 3 player. The other choice is to hold out until the Chinese blitzkrieg subsides . Market sources claim the cost of acquisition is up from `500 to close to `7,000 or `8,000. Maybe if one or more of these do a LeEco and spend themselves out of the market, they'll leave behind a more level playing field.

In a previous interview Keshav Bansal, director, Intex was optimistic that a return was imminent: "It's 100% possible for Indians to come back. Our trump cards are credibility, trust and knowledge of local market." The last, perhaps most difficult option, is to fight these brands by finding the next big opportunity in the mobile space. Something that these players will hopefully be too big or complacent to acknowledge. And then to do unto them, what they did unto the Indian handset makers.

Source: Indian chop-suey: How Desi smartphones lost out to China

No comments:

Post a Comment